Australia Decides - But what does it actually mean for Small Biz?

Apr 28, 2025

🗳️ 2025 Federal Election: What Each Party Means for Small Business

As Australians head to the polls on May 3, small business owners are evaluating how each party's policies could affect their operations. Here's a concise breakdown:

🔴 Australian Labor Party (ALP)

Small Business Policies:

-

Instant Asset Write-Off: Extended the $20,000 instant asset write-off for eligible small businesses until July 1, 2026.

-

Energy Rebates: Offering a $150 energy rebate to eligible small businesses to help offset rising power costs.

-

Skills and Training: Committed to 100,000 additional fee-free TAFE placements from 2027 to help address skill shortages.

-

Taxation: Proposed an unrealised capital gains tax on super balances exceeding $3 million, raising concerns about impacts on small business investment.

Industrial Relations:

-

Secure Jobs, Better Pay Legislation: Introduced reforms including limits on fixed-term contracts, new rights to disconnect from work, and greater protections for workplace delegates.

-

Closing Loopholes Legislation: Measures like ensuring labor hire workers receive the same pay as direct employees, criminalising wage theft, and setting minimum standards for gig workers.

-

Wage Increases: Strong support for wage rises in low-paid sectors like aged care and early childhood education.

🔵 Liberal-National Coalition

Small Business Policies:

-

Instant Asset Write-Off: Plans to increase the instant asset write-off to $30,000 and make it permanent for businesses with turnover under $10 million.

-

Start-Up Support: Proposed a three-year tax offset for new businesses to reduce tax on early earnings and encourage reinvestment.

-

Fuel Excise Reduction: Intends to halve the fuel excise for 12 months, aiming to save households and businesses up to $1,500 annually.

-

Meal and Entertainment Deductions: Introduced a $20,000 tax deduction for small business meal and entertainment expenses.

Industrial Relations:

-

Union Regulation: Plans to seek deregistration of the Construction, Forestry and Maritime Employees Union (CFMEU) due to alleged misconduct.

-

Industrial Relations Reform: Committed to reviewing and amending Labor’s "same job, same pay" laws, which they argue impose unfair burdens on businesses.

🟢 Australian Greens

Small Business Policies:

-

Small Business Grants: Proposed an incubator program offering 1,000 grants of $250,000 and 10,000 grants of $50,000–$75,000 to startups and cooperatives.

-

Instant Asset Write-Off: Supports extending the $20,000 instant asset write-off and maintaining energy efficiency incentives for small businesses.

-

Taxation: Advocates for higher taxes on large corporations and billionaires to fund broader public services.

Industrial Relations:

-

Workplace Reforms: Support initiatives like 12 days of paid reproductive leave and trialling a four-day work week.

-

Gig Economy Protections: Strongly advocate for minimum standards for gig workers and stronger rights for casual employees.

🟡 Independents and Minor Parties

Small Business Policies:

-

Policy Diversity: Many independents propose cutting red tape, offering industry-specific support packages, and championing local manufacturing and entrepreneurship.

Industrial Relations:

-

Case-by-Case Positions: Independents vary widely, but some support lighter regulation to support business growth, while others advocate for stronger worker protections, particularly in regional areas.

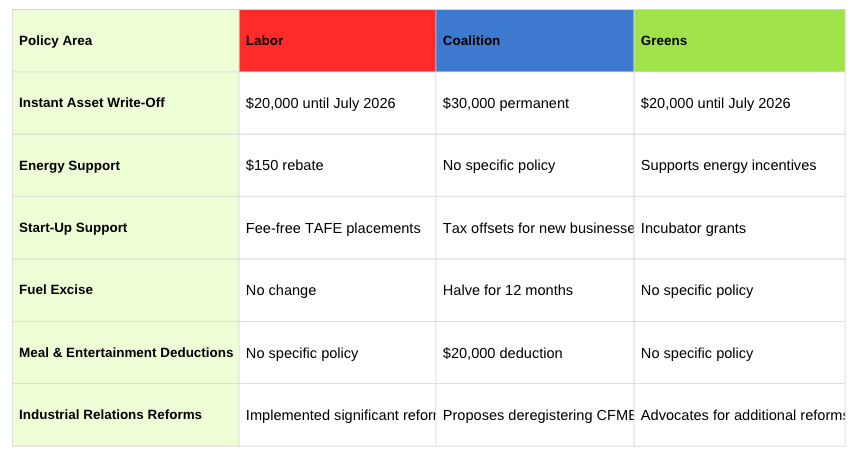

Summary Table

Note: This summary is based on publicly available information as of April 28, 2025. For the most current and detailed information, please refer to the official platforms of each political party.

If you need further details or have specific questions about how these policies might affect your business, feel free to ask!